Leadership Team

DIG Capital ’s current Executive Team is committed to the principles of responsible fund management, uncompromising client service, and inclusive development—the concept that every human, regardless of identity, plays a role in the transformation of societies. We believe that when everyone is included in the development process, innovative solutions to complex problems can emerge, and results are greater for all. The diversity of our staff reflects this commitment.

Founded in 2012, DIG Capital is financial company originally created to serve as the fund management, fund technical services, and investment arm of the Development Innovations Group. DIG Capital senior staff supported DIG’s work in transitioning and developing economies, as well as post-disaster and post-conflict settings throughout the Middle East, Asia, Africa, Latin America and the Caribbean. DIG Capital main project was the Rebati Fund in Haiti.

Executive Team

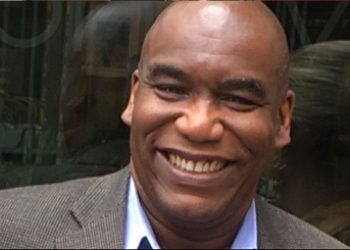

Franck Daphnis

President & Chief Executive Officer (CEO)

Mr. Daphnis is a recognized leader in financial management and international development. He is the author of the Book Housing Microfinance: A Guide to Practice (Kumarian Press, 2004). Mr. Daphnis’s has helped create or manage more than 15 banks or financial institutions around the world. Beyond his fund management expertise, Mr. Daphnis’s professional experience is in the areas of urban environmental management, basic services delivery, inclusive governance, financial inclusion, emergency management, and housing and infrastructure rehabilitation.

Before founding DIG Capital, Mr. Daphnis worked as CHF International’s Director of Field Program Operations. He served as a key advisor on development finance and urban issues for numerous noteworthy institutions including the Cities Alliance, the Consultative Group to Assist the Poor (CGAP), the International Fund for Agricultural Development, the Swedish International Development Cooperation Agency, and the World Bank.

For nine years, he also served as a member of the faculty at the Boulder Institute of Microfinance. Mr. Daphnis has authored and edited two books on housing finance, including the seminal work Housing Microfinance: a Guide to Practice (Kumarian Press, January 2004). He holds a master’s degree in urban planning from Cornell University, as well as a master’s degree in architecture.

Marianne Carliez Gillet

Vice President for Global Programs

Ms. Carliez leads DIG Capitlal SME Technical Assistance practice. Prior to joining DIG Capital, Ms. Carliez worked for the Inter-American Development Bank, the World Bank, the Consultative Group to Assist the Poor (CGAP), and Global Communities. Her regional experience spans across Africa, Asia, Latin America and the Caribbean.

Ms. Carliez played a key role in supporting DIG Capital’s borrowers in Haiti. She helped negotiate loan agreements the financial partners, liaise with regulatory financial institutions, and train financial partners and their clients on best practices, notably regarding housing micro-finance. She has a master’s degree in International Relations from the University of Paris-Sorbonne and a B.A. from the University of California, Davis.

Tara Panek Bringle

Chief Financial Officer (CFO)

Ms. Panek Bringle leads DIG Capital financial fund administration practice and also serves as the organization’s CFO. In this dual role, she ensures that DIG Capital’s technical and financial teams collaborate, allowing us to deliver results with unswerving commitment to contractual compliance.

She specializes in development finance, shelter finance, and post-emergency economic and infrastructure rehabilitation. She played al lead role working with OPIC (now DFC) in designing the Haiti Rebati Facility. She has designed and implemented technical assistance and training programs worldwide to help financial institutions achieve scale and sustainability in providing financial services for the poor around the world.

Ms. Panek Bringle works with a wide range of partners, including the United States Agency for International Development (USAID), large US foundations, non-governmental organizations (NGOs), multi-lateral institutions, and private banks. Ms. Panek Bringle also served as a consistency editor for Housing Microfinance: a Guide to Practice (Kumarian Press, January 2004).